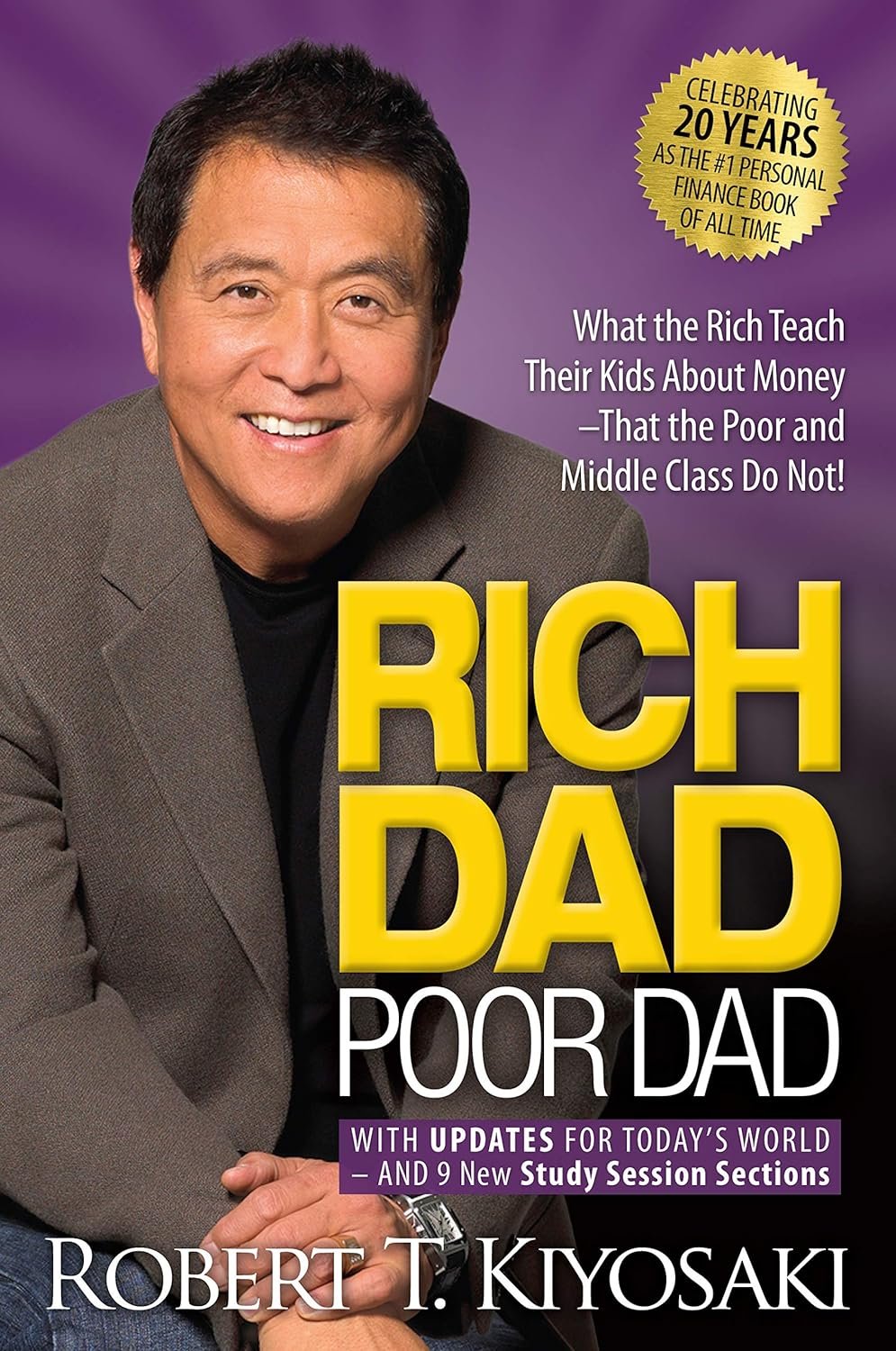

The central theme of “Rich Dad Poor Dad” is the difference in mindset and financial practices between Kiyosaki’s two “dads” – his biological father (Poor Dad) and his best friend’s father (Rich Dad). The book contrasts their philosophies and approaches to money, work, and investing, highlighting the importance of financial education.

Best Tips and Concepts:

- The Importance of Financial Education:

- Rich Dad emphasizes that financial education is crucial for achieving wealth. Traditional education teaches you to work for money, but financial education teaches you how to make money work for you.

- Assets vs. Liabilities:

- One of the most significant lessons is understanding the difference between assets and liabilities. Assets put money in your pocket (e.g., real estate, stocks, businesses), while liabilities take money out (e.g., mortgages, car loans). Accumulating assets is key to financial independence.

- Mind Your Own Business:

- Instead of solely focusing on your job, work on building and managing your own business and investments. This can lead to multiple streams of income and greater financial security.

- The Rat Race:

- The book describes the “rat race” as a cycle where people work hard to pay bills and taxes without ever achieving financial freedom. Breaking out of the rat race requires creating passive income through investments.

- Overcoming Fear and Greed:

- Rich Dad teaches that fear (of losing money) and greed (desire for more money) are the main obstacles to financial success. Learning to manage these emotions is essential for making sound financial decisions.

- Work to Learn, Not to Earn:

- Focus on acquiring skills and knowledge rather than just earning a paycheck. This can involve taking jobs that offer valuable experiences and opportunities for growth.

- Taxes and Corporations:

- Understanding how taxes work and using corporations to protect and grow your assets legally is another key lesson. The rich often use business entities to minimize taxes and maximize returns.

- The Power of Investing:

- Investing is crucial for wealth building. Rich Dad encourages investing in real estate, stocks, and other opportunities that generate passive income and appreciate over time.

- Mindset and Attitude:

- A positive and proactive mindset is essential. Rich Dad advocates for taking control of your financial future, being entrepreneurial, and constantly seeking opportunities.

How It Will Change Your Thinking About Work and Money:

- Shift from Employee to Entrepreneur: You’ll start viewing work not just as a means to earn a paycheck but as a way to gain skills and insights that can be applied to your own ventures and investments.

- Focus on Passive Income: Instead of relying solely on active income from a job, you’ll aim to build passive income streams that provide financial security and freedom.

- Prioritize Financial Literacy: You’ll recognize the importance of continuously educating yourself about finance, investing, and the economy to make informed decisions.

- See Money as a Tool: Money becomes a tool to generate more money rather than just something to spend. This shift in perspective can lead to smarter spending and investing habits.

- Value of Risk-Taking: You’ll learn to embrace calculated risks and see failures as learning experiences, which is crucial for entrepreneurial success.

Overall, “Rich Dad Poor Dad” encourages a mindset that prioritizes financial independence, continuous learning, and strategic investing, fundamentally changing how you view work and money.